Cannabis Stuff Near Me

Med & Rec Dispensaries

Marijuana Doctors

Medical & Recreational Cannabis in Illinois: A Guide to IL Dispensaries

Illinois Recreational Dispensaries

Since legalizing recreational marijuana in 2019, the state of IL now allows all individuals aged 21 and older to purchase legal cannabis at adult-use dispensaries. (Illinois medical dispensaries, on the other hand, are reserved for registered patients only).

In this respect, the process of shopping at adult-use dispensaries is similar to buying alcohol, making accessing cannabis in IL easier than ever.

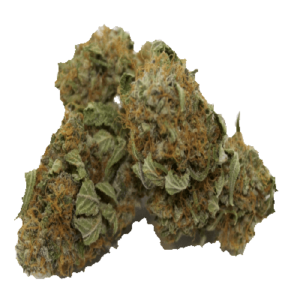

Anyone 21 or older may shop at Illinois recreational dispensaries, which do not require a medical card or registration, making the process similar to purchasing alcohol. Recreational dispensaries typically offer the widest variety of products, including a diverse range of cannabis strains, edibles, concentrates, and other products intended for adult use. Recreational dispensaries may also focus on higher-THC products or strains.

Often, recreational dispensary staff have the expertise to provide guidance and information, to help you find the right product.

Recreational Dispensary Environment

Typically, staff at adult-use dispensaries can offer advice and product guidelines to help guide you toward the cannabis products that best suit your desires. With that said, IL recreational dispensaries do not offer the same level of patient consultation, based on medical needs, that customers at medical dispensaries will encounter. Nonetheless, dispensary staff typically have a wide-ranging knowledge of cannabis and cannabis products, and you will likely find plenty of guidance to help you select the right product.

Recreational Dispensary Products

Recreational dispensaries in IL contain a wide variety of products that generally emphasize recreational, adult use, rather than being targeted for specific therapeutic applications.

IL dispensaries often offer a wide variety of cannabis strains in various formats, from loose flower and prerolls, to vapes and concentrates. You will have the option to choose from a variety of hybrid, indica, and sativa strains, and when shopping for vaporizers or concentrates, you may also have the option to choose from product options infused with various terpenes for targeted effects.

In addition to concentrates, flower, and vapes, many IL dispensaries also offer edibles; cannabis-infused beverages; tinctures; topicals; capsules; and transdermal patches. And unlike medical dispensaries, IL adult-use dispensaries also offer smoking accessories including pipes, bongs, vaporizers, grinders, rolling papers, and much more.

Recreational Dispensary Laws & Limits

At recreational dispensaries, the limits on the amount of cannabis one can purchase in a single visit are slightly narrower than the limits at recreational dispensaries, though they nonetheless leave plenty of room for you to gather all of the product types and variants you’d like to try. At recreational dispensaries, IL residents can purchase the following amounts of product cumulatively:

- 30 grams of flower

- 5 grams of concentrate

- 500mg edibles and infused products

Non-Illinois residents visiting adult-use dispensaries have slightly lower limits, and can purchase a cumulative total of:

- 15 grams of flower

- 250mg edibles and infused products

- 2.5 grams of cannabis concentrate.

These totals are cumulative, meaning that individuals may possess a combination of concentrates, flower, and edibles or infused products so long as the potency or weight of cannabis in each category falls at or under the possession limit.

Illinois Medical Dispensaries

To shop at an Illinois medical dispensary, you must be registered with the state’s medical marijuana program, and visit a qualified physician to acquire a prescription for cannabis. Once you’ve completed these steps, bring your medical card and valid state ID to a medical dispensary in IL. Whereas recreational dispensaries only allow adults 21 and older, medical dispensaries permit registered customers aged 18 and up, and in some cases allow younger customers who have been approved by their physicians, and who are accompanied by a legal guardian.

At the dispensary, medical cardholders will receive guidance by trained staff who can offer product recommendations and patient consultations specifically catered to your medical needs. Medical dispensaries often have trained pharmacists or consultants on their staff who can provide guidance and product recommendations based on your needs.

Medical Dispensary Products

Products at medical dispensaries may focus on products targeted to deliver optimal therapeutic benefits, and those products may have higher levels of CBD, CBG, CBN, and other, minor cannabinoids with specific applications for therapeutic use; products containing a variety of CBD:THC ratios; and both high potency THC products, and options for more strains or products with more balanced ratios of CBD:THC.

Medical dispensaries offer a variety of product formats, including flower, vapes, concentrate, RSO, edibles, transdermal patches, topicals, and capsules. In addition, medical dispensaries may offer a wider selection of tinctures and non-smokeables due to their focus on products appropriate for medical use.

Medical Dispensary Purchasing Limits

At medical dispensaries, the following purchasing limits apply to IL residents with a valid medical marijuana card–like limits at recreational dispensaries, these limits are also cumulative:

- 2.5oz of flower every 14 days.

- 5 grams of concentrate.

- Cannabis infused products with up to 500mg.

Why Register for an IL Dispensary Card

Even though IL has legalized recreational marijuana, medical marijuana in the state remains more popular than ever. There are plenty of advantages associated with having your medical card, including:

Lower Sales Tax (1%)

Medical marijuana patients pay a sales tax of just 1%, which is much lower than the sales tax imposed on non-cardholders shopping at recreational dispensaries. Recreational dispensaries, by contrast, impose a starting sales tax of 6.25% plus the state’s Cannabis Purchaser Excise Tax, which varies based on the THC content of the product being purchased. This tax varies based on THC concentration, and for products at or exceeding 35% THC, can often reach levels of 25%.

Permission to Grow at Home

Registered medical patients in Illinois are permitted to grow up to 5 cannabis plants at home, while recreational consumers cannot grow their own cannabis.

Patient Prioritization

If you hold your medical card, you’ll always be a prioritized patient at Illinois dispensaries. This means that if there is ever a product shortage, dispensaries will consider you first to ensure that you have access to your cannabis treatments. Many hybrid dispensaries also offer express lines for medical patients so you can skip the wait for a quicker, more convenient dispensary experience.

Product Variety Targeted for Therapeutic Benefits

For those managing qualifying conditions, medical dispensaries may also be preferable because medical products harness a wider variety of cannabis compounds with unique therapeutic applications. These include CBD, and other minor cannabinoids and terpenes, that often have specific or advantageous applications for treating qualifying conditions. Moreover, many of the product formats offered at IL medical dispensaries come in formats tailored to therapeutic use.

Expert Guidance by Dispensary Staff

In Illinois, medical dispensaries are equipped with trained staff who can guide you through the purchasing process, answer questions, and ensure that you receive the correct product for your condition and prescription.

Shop at Any IL Dispensary

If you have a medical marijuana card, you aren’t limited to shopping only at medical dispensaries–you can also visit recreational dispensaries and still receive the prioritization and tax break discussed above.

These are just a few of the reasons why, despite recreational legalization, medical marijuana remains as popular as ever in IL.

To sign up for your IL Medical Card or to learn more about the process, click here. In addition to the qualifying conditions approved for treatment with cannabis in the state, Illinois also permits medical marijuana authorization for:

- Veterans. Veterans who are being treated by the VA are eligible to qualify for a medical card, and can begin the process by visiting the online IL Medical Marijuana Patient Registry System to submit VA treatment records from the past 12 months.

- Opioid Pilot Alternative Program. Illinois residents aged 21 and older who have been prescribed opioids for a medical condition are also eligible to register for their medical card. To learn more about the OAPP, click here.